Gian

|

11 min

|

December 24, 2025

As 2025 ends, we look at the innovative sectors shaping the future: AI, biotech, quantum, space, blockchain, robotics & more. Key companies from trillion-dollar leaders to emerging players, all in one guide.

As 2025 wraps up, we are reflecting on an exciting year of technological progress and market shifts. We've identified several innovative sectors that continue to shape the future of finance and industry. These areas blend established leaders with emerging players, offering a mix of stability and growth potential.

Market capitalizations (in brackets) are approximate as of late December 2025 and help compare company sizes, from trillion-dollar giants to smaller innovators.

AI

Artificial intelligence is fundamentally changing how businesses operate, from advanced data processing to automated decision-making. It drives efficiency across industries like healthcare, finance, and manufacturing, with ongoing advancements in generative tools and machine learning making it more accessible and powerful.

NVIDIA (NVDA) – Leading provider of GPUs essential for AI training and inference (~$4.58T)

Microsoft (MSFT) – Integrates AI deeply into cloud services and productivity tools (~$3.63T)

Amazon (AMZN) – Powers AI through massive cloud infrastructure (~$2.48T)

Alphabet (GOOGL) – Advances AI in search, advertising, and research (~$3.80T)

Meta (META) – Develops open-source AI models and applications (~$1.68T)

Yiren Digital (YRD) – Uses AI for financial services in China (~$350M)

Innodata (INOD) – Specializes in AI data preparation and annotation (~$1.71B)

Biotech

Biotechnology focuses on developing new medicines, therapies, and diagnostics using biological processes. It addresses major health challenges like chronic diseases and aging, with rapid progress in drug discovery improving outcomes and quality of life.

Eli Lilly (LLY) – Dominates in treatments for diabetes and obesity (~$1.02T)

Novo Nordisk (NOVO) – Key player in insulin and weight-management drugs (~$231B)

Johnson & Johnson (JNJ) – Broad portfolio across pharmaceuticals and medical devices (~$500B)

Moderna (MRNA) – Pioneers mRNA technology for vaccines and therapies (~$13B)

CRISPR Therapeutics (CRSP) – Leads in gene-editing treatments (~$5.40B)

ABVC BioPharma (ABVC) – Focuses on neurology and oncology pipelines (~$56M)

Quantum Computing

Quantum computing uses quantum mechanics to solve complex problems far faster than classical computers. It has potential in drug discovery, materials science, and optimization, gradually moving from research to real-world utility.

IonQ (IONQ) – Develops trapped-ion quantum systems (~$18B)

IBM (IBM) – Established leader in quantum research and cloud access (~$285B)

Intel (INTC) – Invests in quantum hardware integration (~$172B)

Rigetti (RGTI) – Builds superconducting quantum processors (~$8B)

D-Wave (QBTS) – Specializes in quantum annealing for practical problems (~$10B)

Quantum Computing Inc (QUBT) – Explores photonics-based quantum tech (~$2.56)

Renewables

Renewable energy harnesses sources like solar, wind, and hydro to produce clean power. It supports global efforts to reduce emissions and achieve energy independence, with expanding infrastructure meeting rising demand.

GE Vernova (GEV) – Provides wind turbines and power equipment (~$181B)

NextEra Energy (NEE) – Operates the largest fleet of renewable assets (~$168B)

Brookfield Renewable (BEP) – Manages diversified clean energy portfolios (~$8B)

Clearway Energy (CWEN) – Owns solar and wind generation facilities (~$7B)

First Solar (FSLR) – Manufactures efficient solar panels (~$29B)

Constellation Energy (CEG) – Includes nuclear alongside renewables (~$114B)

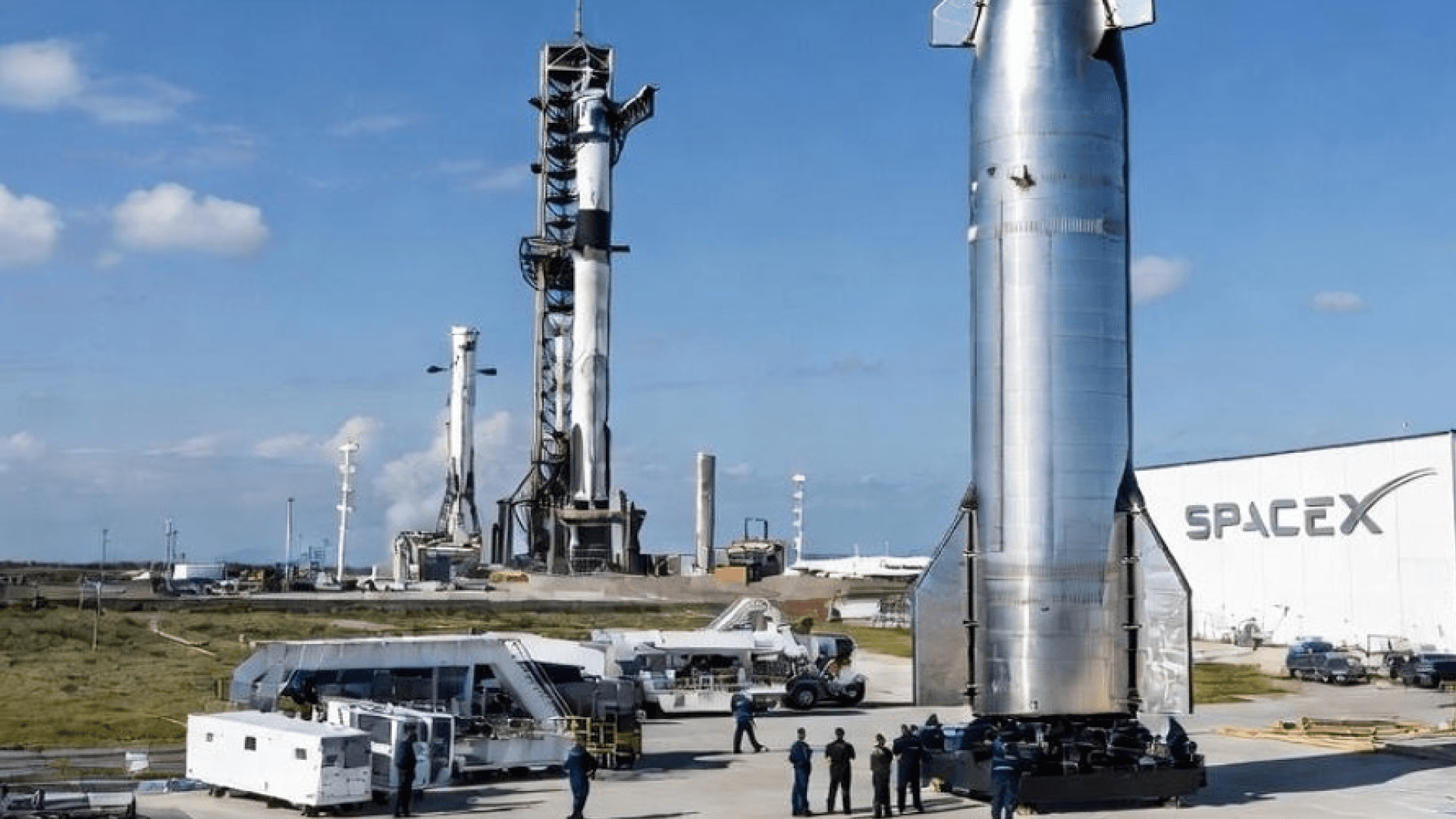

Space Tech

The space technology sector enables satellite communications, Earth observation, and exploration. Commercialization lowers costs and opens new markets in connectivity and data services.

Rocket Lab (RKLB) – Offers dedicated small satellite launches (~$41B)

AST SpaceMobile (ASTS) – Builds space-based cellular networks (~$29B)

EchoStar (SATS) – Provides satellite broadband (~$31B)

Planet Labs (PL) – Delivers daily Earth imaging (~$6B)

Redwire (RDW) – Supplies space components and infrastructure (~$1B)

Virgin Galactic (SPCE) – Focuses on space tourism (~$211M)

Intuitive Machines (LUNR) – Builds lunar landers and services (~$3B)

Autonomous Vehicles

Autonomous vehicles use sensors and AI for self-driving capabilities. They promise safer roads, efficient transport, and new mobility models like robotaxis.

Tesla (TSLA) – Combines EVs with advanced autonomy software (~$1.61T)

Uber (UBER) – Partners for autonomous ride-hailing (~$169B)

General Motors (GM) – Develops through Cruise subsidiary (~$77B)

XPeng (XPEV) – Smart EVs with autonomy features (~$19B)

Aurora Innovation (AUR) – Focuses on self-driving trucks (~$8B)

WeRide (WRD) – Operates robotaxi services (~$3B)

Blockchain/Crypto

Blockchain provides secure, decentralized ledgers for transactions and assets. It enables cryptocurrencies,

tokenization, and decentralized finance with growing institutional interest.

Coinbase (COIN) – Major cryptocurrency exchange platform (~$65B)

Strategy (MSTR) – Holds significant Bitcoin reserves (~$46B)

MARA Holdings (MARA) – Operates large-scale Bitcoin mining (~$4B)

Riot Platforms (RIOT) – Focuses on crypto mining infrastructure (~$5B)

Galaxy Digital (GLXY) – Offers crypto investment and services (~$10B)

Robotics

Robotics automates tasks in factories, healthcare, and daily life using advanced sensors and AI. It boosts productivity and precision in various applications.

Fanuc (6954) – Global leader in industrial robots (~$35B)

Symbotic (SYM) – Automates warehouses with AI robots (~$35B)

ABB (ABBN) – Provides broad industrial automation (~$108B)

Zebra Technologies (ZBRA) – Tracking and automation solutions (~$12B)

Hyundai (005380) – Invests in robotics and mobility (~$48B)

AeroVironment (AVAV) – Unmanned aerial systems (~$13B)

Raytheon (RTX) – Defense-related robotics (~$250B)

Stryker (SYK) – Medical surgical robots (~$136B)

Intuitive Surgical (ISRG) – da Vinci systems for minimally invasive surgery (~$205B)

Rockwell Automation (ROK) – Industrial control and automation (~$45B)

Teradyne (TER) – Robotic testing equipment (~$31B)

AR/VR

Augmented and virtual reality create immersive digital experiences for entertainment, training, and collaboration. Hardware and software improvements make it more practical for consumers and businesses.

Meta (META) – Develops Quest headsets and metaverse (~$1.68T)

Unity (U) – Leading platform for AR/VR content creation (~$19B)

NVIDIA (NVDA) – Powers graphics for realistic rendering (~$4.58T)

Autodesk (ADSK) – Tools for 3D design in virtual spaces (~$63B)

Sony (6758) – PlayStation VR and displays (~$159B)

Qualcomm (QCOM) – Chips for XR devices (~$187B)

Apple (AAPL) – Vision Pro mixed reality headset (~$4.05T)

Clean Energy Storage

Energy storage solutions like batteries store renewable power for reliable supply. They are crucial for grid stability and electric vehicle adoption.

QuantumScape (QS) – Develops solid-state batteries (~$7B)

Fluence Energy (FLNC) – Large-scale storage systems (~$4B)

Enphase Energy (ENPH) – Home solar and battery inverters (~$4B)

Tesla (TSLA) – Produces Powerwall and Megapack (~$1.61T)

Agritech

Agritech applies technology to farming for higher yields and sustainability. Precision tools reduce waste and improve food security.

Deere & Co (DE) – Autonomous tractors and farm tech (~$126B)

Corteva (CTVA) – Advanced seeds and crop protection (~$46B)

Archer-Daniels-Midland (ADM) – Processes agricultural commodities (~$28B)

Bunge (BG) – Global agribusiness and supply (~$17B)

Ingredion (INGR) – Specialty ingredients from crops (~$7B)

Neuromorphic Computing

Neuromorphic chips mimic brain structure for efficient, low-power AI processing. Ideal for edge devices needing fast, energy-saving computation.

IBM (IBM) – Pioneers neuromorphic research (~$285B)

Intel (INTC) – Develops brain-inspired chips (~$172B)

BrainChip (BRN) – Commercial Akida neuromorphic processor (~$263M)

NVIDIA (NVDA) – Supports related AI efficiencies (~$4.58T)

Synthetic Biology

Synthetic biology engineers organisms for new materials, fuels, and medicines. It enables sustainable production beyond traditional methods.

Ginkgo Bioworks (DNA) – Platforms for custom cell programming (~$540M)

Twist Bioscience (TWST) – High-throughput DNA synthesis (~$2B)

Green Hydrogen

Green hydrogen produces clean fuel from renewables for hard-to-decarbonize sectors like industry and transport.

Plug Power (PLUG) – Electrolyzers and hydrogen solutions (~$3B)

FuelCell Energy (FCEL) – Fuel cell technology (~$419M)

Nel ASA (NEL) – Hydrogen production equipment (~$433M)

Edge Computing

Edge computing processes data close to the source for faster response and reduced bandwidth use. Essential for IoT, autonomous systems, and real-time apps.

Fastly (FSLY) – Edge cloud platform (~$2B)

Cloudflare (NET) – Global edge network for security (~$71B)

Akamai (AKAM) – Content delivery and security (~$13B)

3D Printing

3D printing builds objects layer by layer for customized manufacturing. It reduces waste and enables complex designs in aerospace, healthcare, and consumer goods.

3D Systems (DDD) – Broad 3D printing systems (~$229M)

Stratasys (SSYS) – Industrial additive solutions (~$772M)

Gene Editing

Gene editing precisely modifies DNA to treat genetic diseases. Tools like CRISPR offer potential cures for previously untreatable conditions.

Intellia Therapeutics (NTLA) – In vivo CRISPR therapies (~$1B)

Beam Therapeutics (BEAM) – Advanced base editing (~$3B)

Editas Medicine (EDIT) – CRISPR-based medicines (~$216M)

Final Thoughts

These sectors highlight ongoing innovation, combining proven large companies with promising smaller ones. Opportunities abound, but so do risks like market volatility and technical hurdles. A balanced, long-term approach works best.

Merry Christmas and a happy, prosperous New Year from the Valbura Team!

Disclaimer: The content provided in this blog post is for informational and educational purposes only and does not constitute financial, investment, or other professional advice. All data, figures, and examples are illustrative and should not be interpreted as guarantees of future performance or recommendations for specific investment actions. While we strive to ensure the accuracy of the information presented, we make no representations or warranties as to its completeness, reliability, or suitability for your individual financial situation. Always consult with a qualified financial advisor or professional before making any investment decisions. The author disclaims any liability for actions taken based on the information provided herein.